Our

strategies

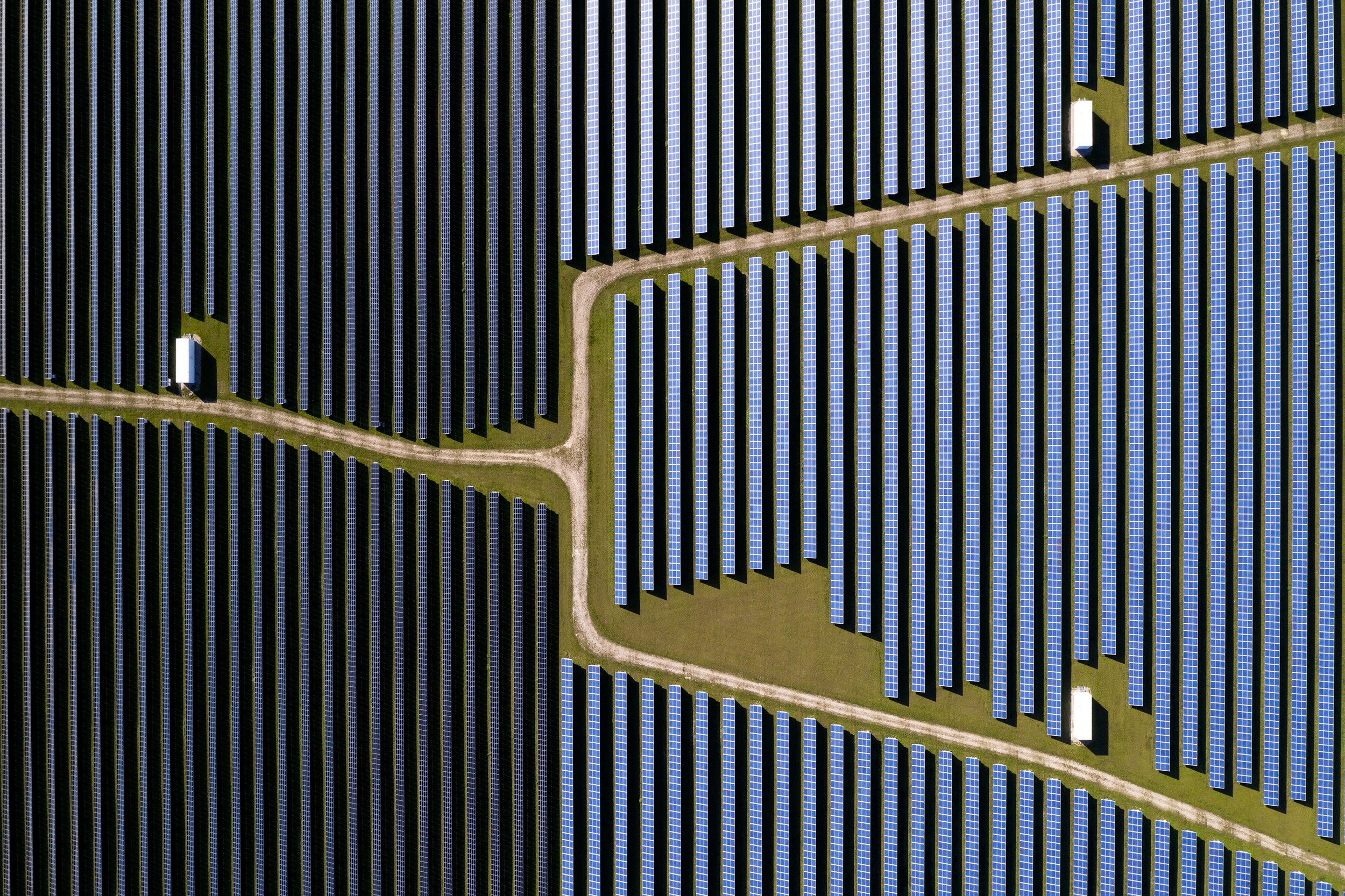

Infranity is a pure play asset management company that provides attractive infrastructure investment solutions. Multiple strategies are run in parallel so as to meet a wide variety of clients objectives. All our strategies follow deeply rooted ESG principles and exclusively focus on real infrastructure assets, Infranity’s core expertise. The investment solutions that we shape benefit from the wide scope of opportunities presented by the infrastructure sector, ranging from solar farms to fiber networks as well as a wide array of instruments across the capital structure.

Our privileged access to a very wide choice of investment opportunities is what allows us to select investments that offer attractive risk returns.

_Alban de la Selle,

Infranity’s Chief Investment Officer

Our Funds

We manage 14 funds1 on behalf of over 50 institutional investors, representing an AUM which is over €8 billion1.

These funds involve investors from various jurisdictions and are either incorporated in France or Luxembourg.

Some of our funds involve single institutional investors which, in turn, market them through their retail networks.

Infranity’s offering has been devised to address the main needs of our clients. It spans thematic to multi-sector investing, with or without geographical focus. Because we invest across the capital structure, our investors have the possibility to invest in debt, equity or any combination of both, depending on their desired risk-return profile.

Our fund offering spans from large senior investment grade debt commingled funds (the latest fund to have ended its subscription period in June 2023 exceeded €1.6 billion1 of commitment) to innovative thematic and enhanced return funds investing in below-investment grade debt (suited to investors in search of higher target yields).

Origination

We source more than 400 investment1 opportunities per year. This is achieved through a constant dialogue with the market from our entire team, drawing on our well-established networks of industrial sponsors, financial investors, banks, advisors, consultants and public organizations. With more than ten nationalities in the team, we gather well informed market intelligence across the infrastructure space to access investment opportunities ahead of the rest of the market.

Selection Process

We have a rigorous process for selecting investment opportunities. Our most valuable assets are the experience, expertise and engagement of our team. Long-standing relationships with industry players across Europe and North America make us the partner of choice for developers seeking funding solutions.

All assets are screened through our proprietary ESG methodology with the support of reputable consultants in this field.

Our privileged access to a very wide choice of investment opportunities is what allows us to select investments that offer attractive risk returns.

Alban de la Selle,

Infranity’s Chief Investment Officer

Our Funds

We manage 14 funds on behalf of over 50 international investors, representing an AUM which is over €8 billion.

These funds involve investors from various jurisdictions and are either incorporated in France or Luxembourg. Our clients are mostly insurance companies but also include pension funds.

Some of our funds involve single institutional investors which, in turn, market them through their retail networks.

Our fund offering has been devised to address the main needs of our clients. It spans thematic to multi-sector investing, with or without geographical focus. Because we invest across the capital structure, our investors have the possibility to invest in debt, equity or any combination of both, depending on their desired risk-return profile.

01

We source more than 400 investment opportunities per year. This is acheived thanks to a constant dialogue with the market from our entire team as well as our Senior Advisors. With more than ten nationalities in the team, we gather well informed market intelligence across the infrastructure space to access investment opportunities ahead of the rest of the market. We achieve this by drawing on our well established networks of industrial sponsors, financial investors, banks, advisors, consultants and public organizations.

02

We follow a rigorous process for selecting investment opportunities. Our most valuable assets are the experience, expertise and engagement of our team. Long-standing relationships with industry players across Europe and North America make us the partner of choice for developers seeking funding solutions.

All assets are screened through our proprietary ESG methodology with the support of reputable consultants in this field.

Our privileged access to a very wide choice of investment opportunities is what allows us to select investments that offer attractive risk returns.

Alban de la Selle,

Infranity’s Chief Investment Officer.

Our sectors

The assets we invest in are tangible, or real assets, that contribute to the quality of life of people today and of the next generations. There are five main fields of infrastructure where Infranity operates :

Energy Transition

Committed to fight climate change, we mobilise capital to accelerate the deployment of renewable energies. Beyond financing single projects, we support credible transitions of utilities towards a < 2°C climate trajectory. We engage in energy efficiency schemes including district heating networks and energy services to industrial and residential customers.

Green Mobility

Green Mobility for people and goods to enhance communication between communities. This includes assets in the rail sector, electric vehicles infrastructure.

Environment

Relates to waste and water management activities and generally includes waste to energy plants, waste water treatment plants and drinking water networks.

Social

infrastructure

Typically relates to assets that contribute positively to the health and education of the communities, such as schools and hospitals.

Digital transformation

For projects that enhance communications between people, like fiber deployment in rural areas and other telecommunications projects.

1Source : Infranity as at July 2023.

Generali Investments Holding S.p.A., data as at 31 December 2021. Generali Investments is part of the Generali Group, which was established in 1831 in Trieste as Assicurazioni Austro-Italiche. Generali Investments Partners S.p.A. Società di gestione del risparmio, Generali Insurance Asset Management S.p.A. Società di gestione del risparmio, Generali Real Estate S.p.A. Società di gestione del risparmio, Infranity, Sycomore Asset Management, Aperture Investors LLC (including Aperture Investors UK Ltd), Lumyna Investments Limited, Plenisfer Investments SGR, are part of Generali Investments, as well as Generali Investments CEE. Please note that the number of countries refers to the number of countries where the different funds of the asset management companies part of Generali Investments are registered for distribution. Please note that not all funds are registered in all the countries and not all the asset management companies are licensed to operate in such countries.

Investment in the products and services of Infranity is intended only for experienced and sophisticated investors who can accept the limited liquidity and the risks associated with such an investment including the possible loss of capital. Infranity’s products and services are only available to “professional clients” and “eligible counterparties” as per the Markets in Financial Instruments Directive (MIFID); they are not available to non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

Investing in Infranity’s products and services involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested. Any reference to a ranking, a rating or an award provides no guarantee for future performance and is not constant over time.

None of the information contained in this document is intended to constitute investment, legal, tax, accounting or other advice. This document is produced purely for the purposes of providing indicative information. Infranity will not be held responsible for any decision taken or not taken on the basis of the information contained in this document, nor in the use that a third party might make of the information. The specific use of the information contained in this website is the sole responsibility of the user. Infranity SAS shall not be held liable for any damages whatsoever resulting from information contained in this website. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of the management company, for any third person or entity in any country or jurisdiction which would subject the company or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.